Introduction

How to file Income Tax Return for Tax years 2014 and 2015

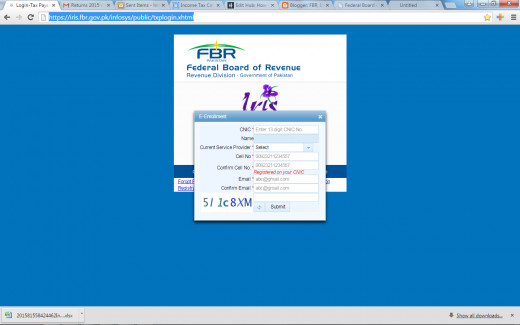

Business individuals having net income of less than Rs.500,000 can file returns mannually, while all other individuals, Association of persons (AOPs) and companies are required to e-file their income tax returns and manual returns are no more acceptable. All individuals registered with Sales Tax are also required to e-file their returns. Tax returns for tax year 2016 can be filed by using the internet portal of FBR of iris . For the individuals having income less than Rs.500,000 can download return form from FBR website and after filling in the date submit the same in the local office of FBR.

For business/salaried individuals and AOPs the deadline for submission of return is 30th September 2016 which will be extended as is done all the years before.

E-file.com Coupon

ReplyDeletePayment vouchers are offered for most payments which do not own a return or notice attached. On-line coupons and discount vouchers aren’t unusual or any kind of new thing. On the website you’ll locate online coupons, goods, sales, reviews, and rebates